![]()

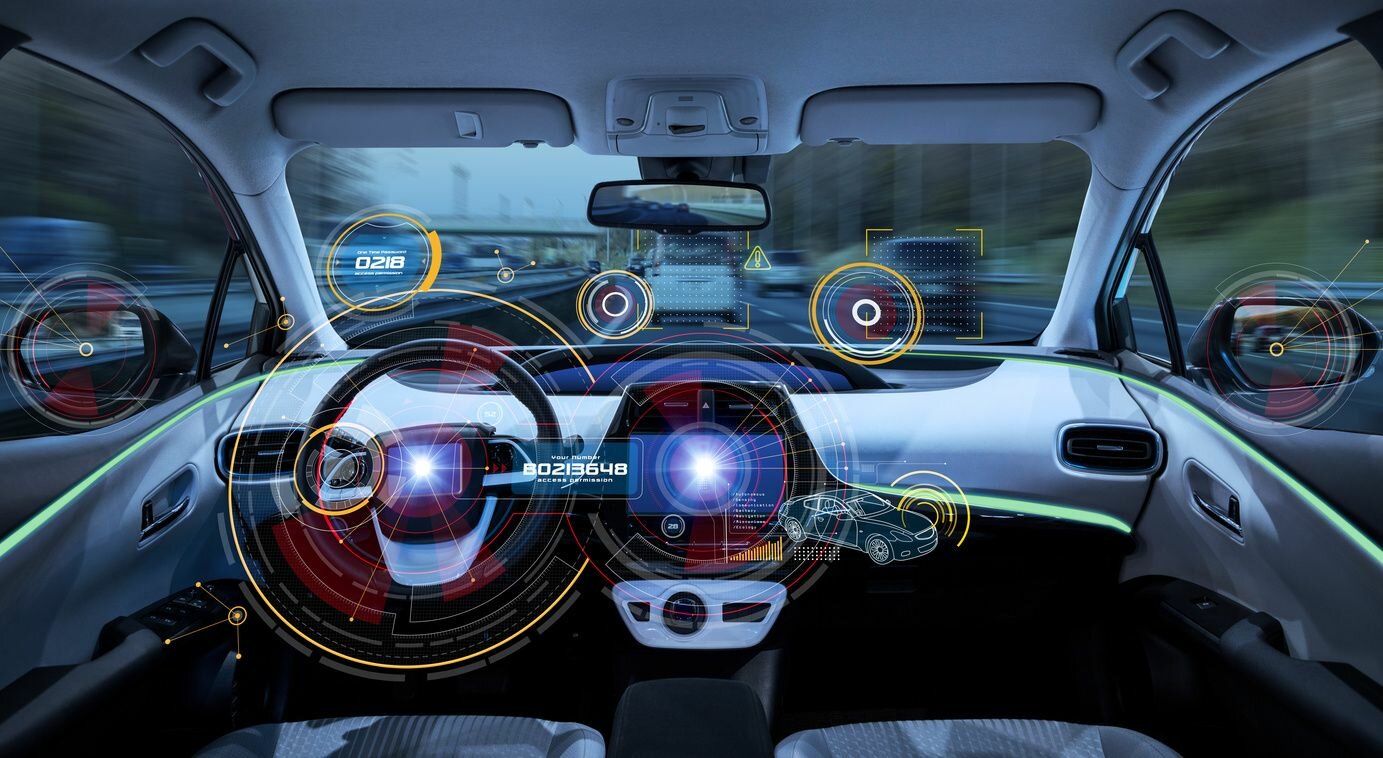

We develop and market breakthrough IDPS technology for IVN authentication-encryption and firmware authentication augmented by CyberHealth monitoring. We provide safety, privacy and data integrity for connected vehicles with our patented, multi-layered embedded software solutions.

Official partners that help us to provide top-notch cybersecurity services: Landon TechnologiesFor more information visit trilliumsecure.com and follow us on

In-Vehicle

In-Vehicle Firmware Authentication

Firmware Authentication Secured Updates

Secured Updates Multilayer IDPS &

Multilayer IDPS &